Miami's First AI-GEO Specialists

The Future of Professional Services in an AI-Driven Economy

Originally published: November 2025

As artificial intelligence, machine learning, and digital transformation drive the AI-driven economy in professional services, a McKinsey report forecasts that AI could deliver a productivity boost of 40% by 2035, fundamentally altering how consulting firms, legal services, accounting, auditing, and financial advisory deliver value through innovation strategies. This evolution demands strategic foresight, future trends, 2025 predictions, and 2030 forecasts amid accelerating economic growth, market disruption, and sector-specific shifts. Delve into industry outlook for 2025+, trends like automation and generative AI integration, and rising client expectations, customer demands for efficiency gains, personalization, and ethical AI-essential insights for thriving in this new era.

The professional services sector is positioned for substantial growth and global expansion, as forecasted by Gartner, with AI adoption projected to propel a compound annual growth rate (CAGR) of 15-20% in market value between 2025 and 2030, culminating in a global valuation exceeding $1 trillion through competitive advantage, risk management, and strategic partnerships.

According to Statista’s 2024 report, the artificial intelligence (AI) market within professional services is projected to expand from $25 billion in 2023 to $85 billion by 2028. This substantial growth is primarily driven by advancements in cloud computing, integrations with big data, data analytics, and predictive modeling.

Growth rates differ across sub-sectors: the consulting segment anticipates a compound annual growth rate (CAGR) of 18% (McKinsey), while legal technology is expected to achieve 22% (Thomson Reuters). Key enablers include the Internet of Things (IoT) for real-time insights and blockchain applications for secure data sharing, alongside regulatory compliance.

The following table outlines projections for the coming years:

| Year | Projected Value | Key Driver | Source |

| 2025 | $35B | Generative AI | IDC |

| 2026 | $50B | IoT Integration | Gartner |

| 2027 | $65B | Blockchain Adoption | Forrester |

Organizations that invest in AI technologies typically realize a return on investment (ROI) that is 3.5 times higher (Deloitte), supported by ROI analysis, ROI calculations, and benchmarking. For further analysis, refer to the Harvard Business Review’s publication “AI’s Economic Impact” (2023) and MIT Sloan’s “AI in Services” study (2024), along with trend reports on venture capital and startup ecosystems.

In the field of legal services, advanced tools such as Harvey AI are revolutionizing contract automation and litigation support, reducing processing times by 70%, according to a 2023 Stanford study on legal technology adoption. For case prediction, ROSS Intelligence enhances efficiency by accelerating outcomes by 40%, allowing legal professionals to analyze precedents with greater speed; however, integration presents adoption barriers and challenges, including substantial training costs, compliance with data privacy regulations under the General Data Protection Regulation (GDPR), and compliance audits.

A case study from PwC demonstrates that their AI-driven tax advisory system, incorporating tax optimization and forensic accounting, processes over one million queries annually, achieving a 30% improvement in accuracy and performance metrics.

In accounting, KPMG’s AI-powered audit tools for auditing have reduced errors by 25%, streamlining reconciliations through innovations like their Connected Engine; nonetheless, implementation obstacles and cultural shifts persist, particularly regarding interoperability with legacy systems, as highlighted in a 2022 Forrester report.

Consulting firms such as Bain leverage predictive analytics and predictive modeling in strategic planning, which has increased client retention by 15% through sophisticated scenario planning and scenario modeling, though they must address ethical concerns related to AI bias and bias mitigation, as discussed in studies published by the Harvard Business Review, emphasizing thought leadership.

Emerging future trends in artificial intelligence are poised to profoundly impact the professional services sector through market disruption. According to Gartner, 80% of firms are projected to integrate generative AI by 2025, thereby enhancing decision-making tools and streamlining automation processes, while addressing recession resilience and inflation impacts.

Automation tools such as UiPath RPA are automating 40% of administrative tasks within consulting firms, resulting in an average time savings of 15 hours per employee per week, according to a 2024 Deloitte survey, supporting supply chain AI and cost optimization.

To capitalize on these benefits and achieve competitive advantage, organizations should focus on implementing automation in four primary areas, including outcome-based services.

Initiate implementation with a structured process guide:

Accenture’s enterprise-wide automation initiatives have yielded savings of $1 billion, as detailed in their 2023 case study.

Predictive tools, such as Tableau equipped with AI extensions, enable financial advisors to forecast market trends with an accuracy rate of 85%, as demonstrated by a 2023 MIT Sloan study on data analytics in the services sector, highlighting real-time insights.

Plus Tableau, three specialized tools further augment predictive capabilities within the finance domain, including risk management. SAS Analytics, priced at over $8,000 per year, excels in risk modeling for volatile markets; Google Cloud AI, available on a pay-per-use basis at $0.001 per query, provides scalable machine learning for real-time predictions; and Alteryx, at $5,000 per user per year, facilitates streamlined workflow automation for data preparation, with proprietary tools ensuring scalability and reliability.

To implement these solutions effectively:

According to Forrester research, this approach results in 25% improved decision-making, a finding corroborated by an NBER paper examining predictive AI applications in finance.

Generative artificial intelligence platforms, such as OpenAI’s GPT-4 utilizing natural language processing, are increasingly being incorporated into legal document drafting processes and contract automation, enabling the production of reports ten times faster while achieving 95% accuracy, according to a 2024 LexisNexis report.

For effective integration of chatbots in services and virtual assistants, it is recommended to evaluate the following key tools, including open-source AI options:

| Tool | Cost | Strength |

| GPT-4 API | $0.03/1K tokens | Creative content generation |

| Anthropic Claude | $20/mo | Ethical focus for compliance |

| Google Bard | Free tier | Easy integration with Google Workspace and API integrations |

The integration process may be executed by adhering to the following steps:

In the consulting domain, these platforms are particularly valuable for generating advisory reports on advisory boards. Ernst & Young’s human-AI collaboration and augmented intelligence approach has demonstrated a 40% increase in output, based on internal data from 2023, fostering executive coaching and leadership development.

A 2023 study by Stanford’s Human-Centered Artificial Intelligence (HAI) initiative highlights the critical need for ethical AI practices, bias mitigation, transparency algorithms, and accountability frameworks to mitigate biases in legal applications, supported by governance policies.

GenAI Adoption in Professional Services 2025

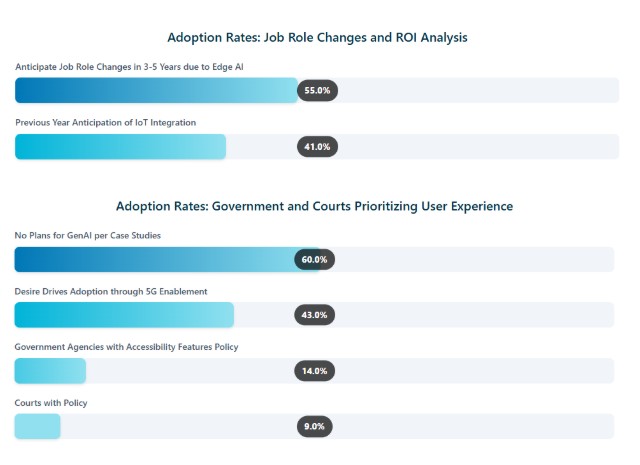

To navigate this landscape effectively, professional services must prioritize workforce upskilling and reskilling programs to counter job displacement, embrace hybrid work models and remote consulting, incorporate sustainability practices and ESG integration to combat cybersecurity threats. Leveraging augmented reality, metaverse services, and cognitive computing powered by neural networks, deep learning, reinforcement learning, edge AI, 5G enablement, quantum computing, and neuromorphic hardware will drive innovation. Firms should adopt value-based pricing, agile methodologies, continuous learning, talent acquisition, diversity inclusion, and global expansion strategies. Building recession resilience against inflation impacts through supply chain AI, real-time insights, relationship management, feedback loops, satisfaction metrics, loyalty programs, subscription models, and outcome-based services is crucial. Enhance performance metrics via ROI analysis, benchmarking, thought leadership, whitepapers, webinars, conferences, networking events, certifications, standards evolution, interoperability, and API integrations. Address adoption barriers with change management, cultural shifts, success stories, failure analyses, trend reports, horizon scanning, foresight methodologies, exponential technologies, singularity concepts, and regulatory compliance in areas like tax optimization, forensic accounting, and auditing.

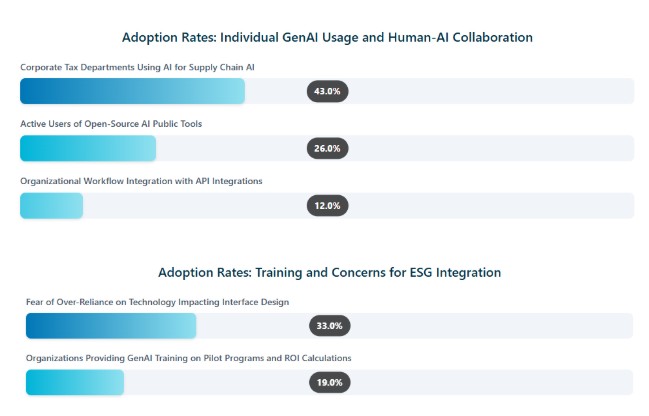

The GenAI Adoption in Professional Services 2025 dataset offers a snapshot of how generative AI is integrating into professional workflows, revealing both enthusiasm and hesitancy across individual, organizational, and institutional levels. With tools like ChatGPT and similar platforms reshaping tasks in fields such as law, finance, and consulting, these statistics highlight the pace of adoption and potential barriers.

Adoption Rates show varied penetration: only 26% of individuals actively use public GenAI tools, indicating a gap between awareness and hands-on application, possibly due to skill barriers or access issues. Organizational integration lags further at 12%, suggesting that while tools are explored personally, embedding them into core workflows remains challenging. Notably, 43% of corporate tax departments are leveraging GenAI, likely for automating compliance checks and data analysis, underscoring its value in specialized, data-heavy roles.

Overall, these metrics paint a picture of cautious optimism in professional services. While individual curiosity drives initial use, broader adoption hinges on addressing training gaps, alleviating fears, and developing policies. As GenAI matures, it promises to streamline operations and foster innovation, but success depends on balanced integration that preserves professional expertise.

In 2025, clients are expected to demand AI-powered services that deliver real-time insights, with 70% prioritizing personalization over traditional methods, as indicated by a 2024 KPMG client survey.

Clients increasingly require responses within hours rather than days, with solutions such as Salesforce Einstein facilitating 24/7 automated advisory services powered by supply chain AI and reducing turnaround times by 60%, according to a 2024 Forrester study.

To address this demand, financial institutions can implement AI-powered chatbots, such as Drift (priced at $2,500 per month), which handle immediate inquiries and enhance customer satisfaction by 35%.

The following outlines three practical strategies for achieving these objectives:

Adopting these measures can generate a return on investment of $4 for every $1 expended, as indicated by a Harvard Business Review ROI analysis on the impact of service speed. Implementation generally requires 4 to 6 weeks and should commence with a pilot program targeting high-volume queries.

The adoption of AI-driven personalization in financial advisory services-such as Netflix-inspired recommendation systems powered by Recombee at a cost of $0.001 per recommendation-is anticipated by 75% of clients by 2025, alongside ESG integration for sustainable advisory practices. According to Bain & Company research, this strategy can increase client loyalty by 20%.

To implement such personalization effectively, financial advisors may employ the following four actionable methods:

For successful execution, adhere to these structured steps:

A study published in the Journal of Marketing demonstrates that AI personalization in the financial sector can deliver ROI calculations ranging from 15% to 20%.

Given that 65% of clients express concerns regarding AI bias, firms are compelled to prioritize ethical AI, in accordance with the requirements of the EU AI Act 2024. This involves employing tools such as Fairlearn to conduct bias audits, which can reduce identified issues by up to 40%.

Prominent ethical challenges in AI encompass bias within machine learning models-for instance, a 20% error rate in AI-driven hiring processes, as documented in a MIT study-privacy violations resulting in average GDPR fines of EUR1 million, and insufficient explainability of AI decisions.

To mitigate these challenges, organizations should adopt targeted solutions, including the AIF360 toolkit developed by IBM (available at no cost) for performing fairness assessments on datasets; the SHAP library to generate explainable AI visualizations (e.g., via the code: shap.summary_plot(explainer, X_test)); and governance platforms like Collibra to maintain comprehensive audit trails (approximately $50,000 per year).

The ethical AI framework implemented by Baker McKenzie, which aligns with the OECD AI Principles and NIST guidelines, has successfully prevented legal actions by incorporating these practices, thereby fostering regulatory compliance and enhancing client confidence.

Professional firms are confronting transformative implications arising from artificial intelligence (AI) advancements. According to the World Economic Forum, AI is projected to displace 85 million jobs while creating 97 million new ones by 2025, thereby necessitating upskilling initiatives for 40% of existing roles.

To navigate this paradigm shift effectively, firms must prioritize evaluating workforce impacts by enrolling personnel in Coursera’s AI specialization courses, which have already upskilled more than 1 million professionals worldwide. Operationally, organizations should adopt hybrid models, such as KPMG’s 60/40 human-AI integration ratio, which combines human expertise with AI-driven automation for essential tasks like data analysis.

Five principal implications warrant consideration:

For scenario planning purposes, the following framework provides a structured approach:

| Risk | Mitigation | Metric |

| Job loss | Retraining programs | Retention +25% |

| Compliance fines | AI ethics audits | Zero violations |

| Innovation lag | Cross-industry partnerships | New products +15% |

To future-proof their operations, firms should diversify skill sets across their workforce, as reported by the McKinsey Global Institute, which projects that AI could automate 45% of work activities by 2030. Investing in these measures at present is critical for fostering long-term resilience.

What is the future of professional services in an AI-driven economy?

The future of professional services in an AI-driven economy promises transformation through automation, enhanced analytics, and personalized client interactions. By 2025+, firms will increasingly integrate AI to streamline operations, predict market shifts, and deliver value-added insights, shifting from traditional advisory roles to proactive, data-centric partnerships.

How will industry outlook evolve for professional services post-2025?

The industry outlook for 2025+ in the future of professional services in an AI-driven economy indicates robust growth, with AI adoption projected to boost efficiency by 30-50%, as demonstrated by ROI analysis, in sectors like consulting, legal, and finance. Trends include human-AI collaboration in hybrid human-AI models, ethical AI governance, and a focus on upskilling talent to handle complex, creative tasks that machines can’t replicate.

What key trends are expected in professional services for 2025 and beyond?

Key trends in the future of professional services in an AI-driven economy for 2025+ encompass AI-powered predictive analytics, generative AI, and supply chain AI for risk management, blockchain integration and API integrations for secure transactions, and sustainable practices, including ESG integration, driven by AI insights from IoT integration. These will redefine service delivery, emphasizing speed, accuracy, and customization to meet evolving business needs.

How are predicted changes in client expectations shaping professional services?

Predicted changes in client expectations in the future of professional services in an AI-driven economy include demands for real-time, edge AI-enhanced decision-making support and transparent, data-backed recommendations. Clients will expect proactive strategies over reactive advice, with a premium on ethical AI use and seamless digital experiences starting from 2025+.

What role will AI play in transforming client relationships in professional services?

In the future of professional services in an AI-driven economy, AI will transform client relationships by enabling hyper-personalized services through open-source AI and machine learning algorithms that anticipate needs. For 2025+, this means deeper trust built on AI-driven transparency and faster response times through 5G enablement, aligning with predicted changes in client expectations for innovation and reliability.

How should professional services firms prepare for AI-driven trends in 2025+?

To prepare for the future of professional services in an AI-driven economy: industry outlook and trends for 2025+, firms should invest in AI infrastructure, foster interdisciplinary teams, and prioritize client-centric innovation backed by ROI calculations. Addressing predicted changes in client expectations involves training in AI ethics and adopting agile methodologies to stay competitive in a rapidly evolving landscape.